Why Do Businesses Need a Credit Policy?

It’s important for a business to have an established credit policy because it helps team members and customers to stay aligned on expectations. Without clear credit policy guidelines, a business is exposed to more risk, as many decisions will be left up to team members’ judgements, leaving more room for error and confusion.

Here are some ways credit policies can improve business operations:

- Streamlines internal processes: Since a credit policy gives team members a standard point of reference for all credit decisions, they’ll spend less time asking for guidance. Team members can instead act decisively, knowing that their decisions are backed up by official company policy.

- Improves customer accountability: Well-thought-out credit policies provide clear terms for customers to adhere to. They know when they’re expected to pay and understand the repercussions of missed deadlines.

- Decreases default accounts: When a credit policy accounts for a customer’s current financial standing and payment history, a business can offer them a line of credit that’s easier to manage. Customers will then be less likely to overextend themselves.

- Improves cash flow: A credit policy that reduces missed payments positively impacts other areas of operations, like cash flow, by giving the business a dependable revenue stream to plan around.

The function of credit policies is to create an effective plan of action that is mutually beneficial to the business and its customers.

What Influences a Credit Policy?

A credit policy is subject to a number of factors that can change from month to month and from customer to customer. Keep these credit policy variables in mind to give yours the greatest chance of success possible.

1. The Economy

Terms of credit are highly dependent on the state of the economy. If interest rates are anticipated to rise, your customers might be restricted from financing. If the economy turns into a bull market, customers may have more access to funds. Revisit your credit policy periodically to ensure the terms account for important changes to the economic climate at large and your industry in particular.

2. Your Cash Flow

Even when the economy is in good shape, your business can experience financial fluctuations. Account for potential increases or decreases to your cash flow when creating a policy. When your cash flow is high, you can entertain more lenient terms of credit. When cash flow is low, it may be smart to err on the stricter side.

3. The Customer

The customer is another variable and an effective credit policy will recognize their unique position. The size of a customer’s business, their number of clients, and their financial history will all play a role in determining their degree of risk.

4. Your Competition

A major benefit in offering credit to your customers is that it can give you a competitive edge over your competition. If your competitors also offer credit, then you’ll need to provide better, or at the very least comparable, rates to maintain this benefit.

What Makes Up a Credit Policy?

While a policy needs to be tailored to your business’s goals, it’s important to address these common credit policy objectives:

- Credit limits: What’s the maximum credit offering you feel comfortable giving to a single customer? How much credit is your business able to issue at one time without interrupting your cash flow?

- Payment terms: Will you accept payments via credit cards, bank transfers, or checks? What is the maximum length of net terms you’ll allow? Will there be an interest fee or penalty for late payments?

- Customer information: What will your business need to know about the customer? Is some information required while other information is optional?

- Customer qualifications: What criteria must the customer meet for credit approval? How will their credit history or financial status impact the amount of credit they have access to?

- Invoicing practices: What information will be included on invoices? How soon after the receipt of the goods or service will the invoice be delivered?

- Collection terms: If an invoice goes unpaid, how long will you wait before involving an outside debt collector? When will you take a customer to court?

If your company operates in a niche industry, your credit policy should also address any unique factors that may impact its success.

How To Create Your Credit Policy in 6 Steps

Make the task of writing a credit policy more manageable by breaking it down into these steps.

1. Create Mission Statement

A credit policy should start with a declaration of the purpose behind the document. This can be a short paragraph identifying the document as the company’s credit policy and its intended use.

2. Identify Internal Goals

A credit policy is more than just a series of guidelines for employees to follow. It’s also crafted to target specific goals, like:

- Limiting bad debt

- Reducing days sales outstanding

- Opening a specific number of new accounts

These types of goals give your credit department standards by which to measure their performance.

3. Designate Team Responsibilities

Avoid having tasks fall through the cracks or conflict arising by clearly identifying the roles within the credit department and what they are responsible for. Key roles often include:

- Chief financial officer (CFO): oversees the department through management of financial initiatives and staff delegation

- Credit manager: manages day-to-day activities of the credit department, authorizes credit limits, and sets department procedures; reports to CFO

- Credit analyst: collects and analyzes financial records for customers seeking credit limits up to a certain amount; reports to credit manager

- Collections manager: coordinates collection resources, including the use of outside agencies, and authorizes payment terms in support of the Credit Manager; reports to credit manager

- Billing manager: responsible for maintaining accurate invoice records, resolving billing disputes, and other related matters; reports to credit manager

Depending on the size of your department, it may also be worth calling out supporting roles, such as those reporting to specific managers.

4. Specify Credit Evaluation Procedure and Criteria

A good credit policy formalizes the criteria a customer must meet to gain credit approval, leaving as little up to the discretion of a team member as possible.

Here’s one way to organize your criteria for easy reference:

You’ll also want to identify when credit limits are reevaluated. A customer’s financial status can change quickly, and it will tell you if you can give them access to more credit or if you should temporarily decrease it.

Some services, like Nuvo, can actively monitor credit qualification criteria so you always have up-to-date information. If your credit department manually monitors customer accounts, then you should be reviewing them yearly at the very least.

Nuvo Tip:

It’s OK to allow for flexibility in some procedures where appropriate, such as substituting a bank reference for a suitable professional reference with bank account records.

5. Define Terms and Conditions

Your terms and conditions define your expectations and intentions when entering a sales agreement while also protecting your rights. These should be included in important documents, such as credit applications and sales contracts, with a required signature from the customer to confirm their consent.

It’s a good idea to include terms and conditions on less important documents and communication as well. Consider adding them to emails, sales orders, and invoices to cover your bases every step of the way.

6. Define the Collections Process

Even the most finely crafted credit policies will experience the occasional past due account. It’s best to have a comprehensive road map for how to handle these situations so that you can handle them effectively when they arise.

Here’s one option for establishing a credit collections timeline:

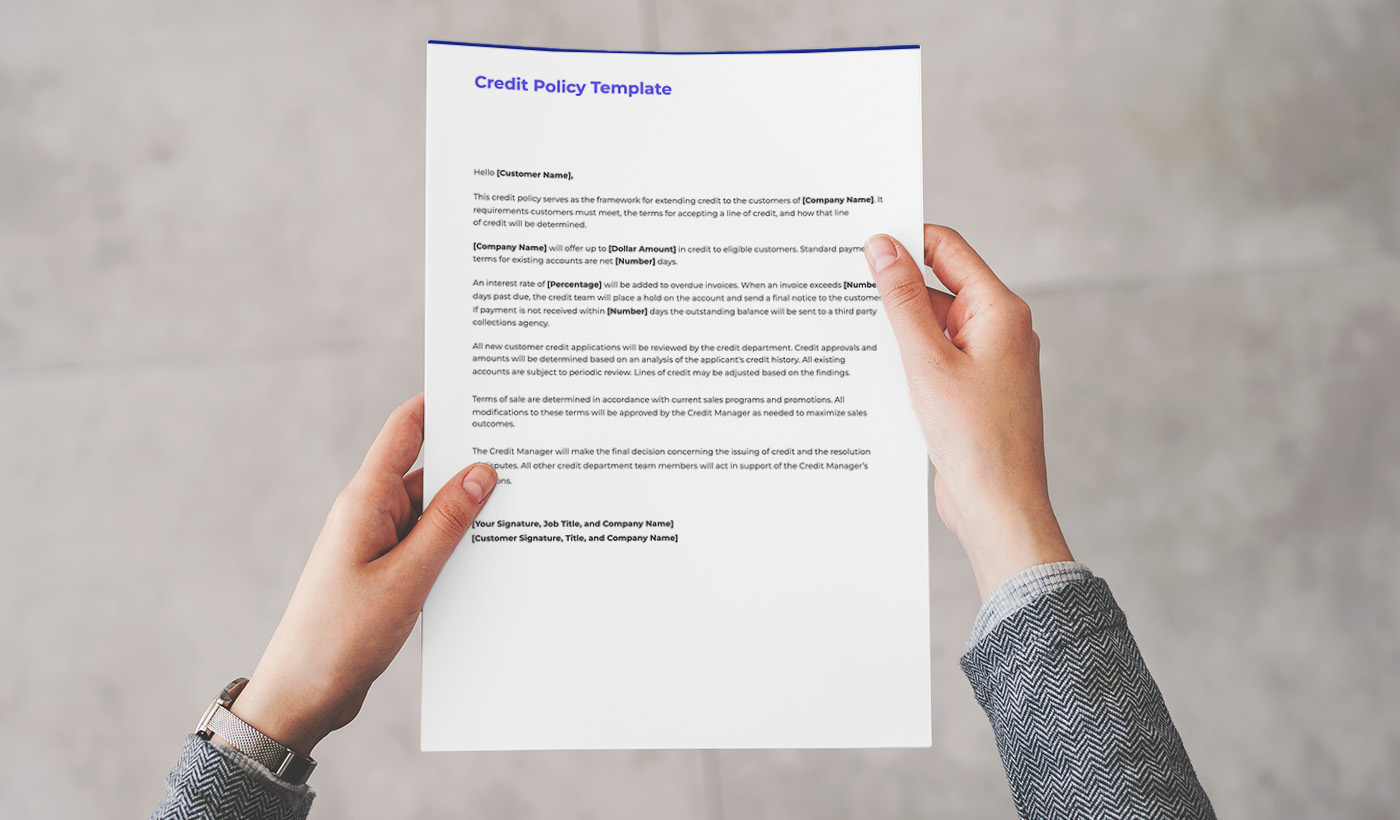

Credit Policy Example

When you establish your credit policy or make an update, it’s wise to notify affected customers to get their sign-off and preserve your working relationship. This can be accomplished by sending a condensed version of the credit policy containing the necessary information.

Here’s one way to go about creating that credit policy template:

This credit policy serves as the framework for extending credit to the customers of [Company Name]. It establishes the requirements customers must meet, the terms for accepting a line of credit, and how that line of credit will be determined.

[Company Name] will offer up to [Dollar Amount] in credit to eligible customers. Standard payment terms for existing accounts are net [Number] days.

An interest rate of [Percentage] will be added to overdue invoices. When an invoice exceeds [Number] days past due, the credit team will place a hold on the account and send a final notice to the customer. If payment is not received within [Number] days, the outstanding balance will be sent to a third-party collection agency.

All new customer credit applications will be reviewed by the credit department. Credit approvals and amounts will be determined based on an analysis of the applicant's credit history. All existing accounts are subject to periodic review. Lines of credit may be adjusted based on the findings.

Terms of sale are determined in accordance with current sales programs and promotions. All modifications to these terms will be approved by the credit manager as needed to maximize sales outcomes.

The credit manager will make the final decision concerning the issuing of credit and the resolution of disputes. All other credit department team members will act in support of the credit manager’s decisions.

[Your Signature, Job Title, and Company Name]

[Customer Signature, Title, and Company Name]

Consider your credit policy a living document that needs periodic updates — the same way a car needs regular maintenance. And when in doubt, don’t forget Nuvo is here to help streamline your credit extension processes.

Credit Policy FAQs

Credit policies can vary greatly from one business to another. Look to these extra tips for help building yours.

What Are the 5 C’s of Credit?

The 5 C’s of credit are used to help lenders determine the suitability of a loan or advance. They are as follows:

- Capacity: the customer’s debt-to-income ratio

- Conditions: factors within and outside of the customer’s control, such as the amount of credit requested, the interest rate that’s applied, and how they intend to use the money

- Collateral: the assets a customer will offer if they default on the advance

- Character: the customer’s financial history, including a review of their credit reports and their handling of past loans

- Capital: how much upfront money, if any, the customer intends to put toward their purchase, like a down payment on a car

How Many Types of Credit Risk Are There?

There are five types of commonly held credit risks:

- Institutional risk: the danger of an overseer or intermediary failing to comply with regulations or honor contractual obligations

- Downgrade risk: the chances of a borrower’s credit rating being reduced, making it harder for them to access lines of credit and, in turn, making it harder to pay off debts

- Default risk: the possibility of the customer failing to repay their loan

- Concentration risk: the danger of a financier focusing a large amount of their resources on a single industry

- Country risk: the chances of a country experiencing an economic downturn, political unrest, or defaulting on its financial obligations

How Does Credit Policy Influence Sales?

A sound credit policy can increase sales by making a business’s services more accessible to a broader group of customers. The credit policy can also help with the allocation of resources, making a business’s services more affordable than competitor offerings.

.png)